georgia ad valorem tax motorcycle

Acceptable Proof of Georgia Vehicle Liability Insurance Coverage Proof of insurance filed by your insurance company in the Department of Revenues database. Use the GA DOR tax calculator to estimate the tax on your vehicle.

Tax Rates Gordon County Government

Of an automobile a tramcar a trailer or a motorcycle with a gas displacement of over 150 millilitres within China.

. On any purchase import self-production receipt as a gift or award etc. May only be issued for a private passenger motor vehicle or motorcycle a truck weighing 14000 pounds or less or a recreational vehicle used for personal transportation that is owned or leased by the applicant. If you have just sold your vehicle in Georgia you must correctly fill out the title to assign it to your buyer.

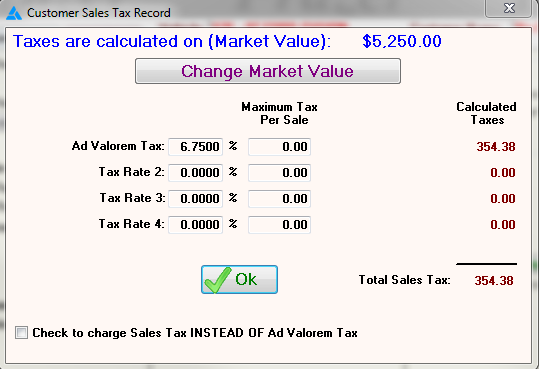

Uniform tax valuations used in calculating Title Ad Valorem Tax TAVT and motor vehicle ad valorem taxes are certified to county tax commissioners by the Georgia Department of Revenue. TAVT is calculated at fair market value multiplied by the TAVT rate which is currently 66If you wish to dispute the assessed value of your vehicle you may appeal the value at the time of your. Vehicles in Georgia must be registered and have license plates issued by the Georgia Department of Revenue DOR county tag offices in order to drive them legally on public roads.

Title ad valorem tax. You have 30 days from the purchase or transfer date to register and obtain a license plate or to transfer your existing Georgia license plate from a vehicle you no. GEORGIA None calculated on the sales price of nonfor motorized motor vehicles that are titled in Georgia eg car truck motorcycle RV 4 for non-motorized motor vehicles eg tow-behind campers and trailers YES on non-motorized motor vehicles NO credit is allowed against the Title Ad Valorem Tax TAVT YES.

Georgia License Plates Placards. Visit our Car Registration in GA page to learn more. A disabled persons license plate.

A 10 ad valorem tax due based on your vehicles value. Taxes Subject to Title Ad Valorem Tax TAVT Annual Motor Vehicle Ad Valorem Tax or Georgia Sales and Use Tax. According to Chapter 22 of Publication 17 the IRS allows you to deduct the ad valorem tax vehicle value off your income taxes.

Import duty is charged in ad valorem specific compound. You may also need additional documents to register your vehicle in Georgia. 25 of the tag fees.

This is the portion thats based on your cars value. With the changes made since the 1994 tax reform China has sought to set up a streamlined tax system geared to a socialist market economy. Value-added tax VAT An individual engaged in the sale or importation of goods.

Taxes provide the most important revenue source for the Government of the Peoples Republic of ChinaTax is a key component of macro-economic policy and greatly affects Chinas economic and social development. Coverage can be verified using DRIVES e-Services Registration and Insurance Status.

Tavt Information Georgia Automobile Dealers Association

2021 Property Tax Bills Sent Out Cobb County Georgia

The New Title Ad Valorem Tax Tavt In Simple Terms Lake Lanier

Vehicle Taxes Dekalb Tax Commissioner

Georgia Motor Vehicle Ad Valorem Assessment Manual

T146 Fill Online Printable Fillable Blank Pdffiller

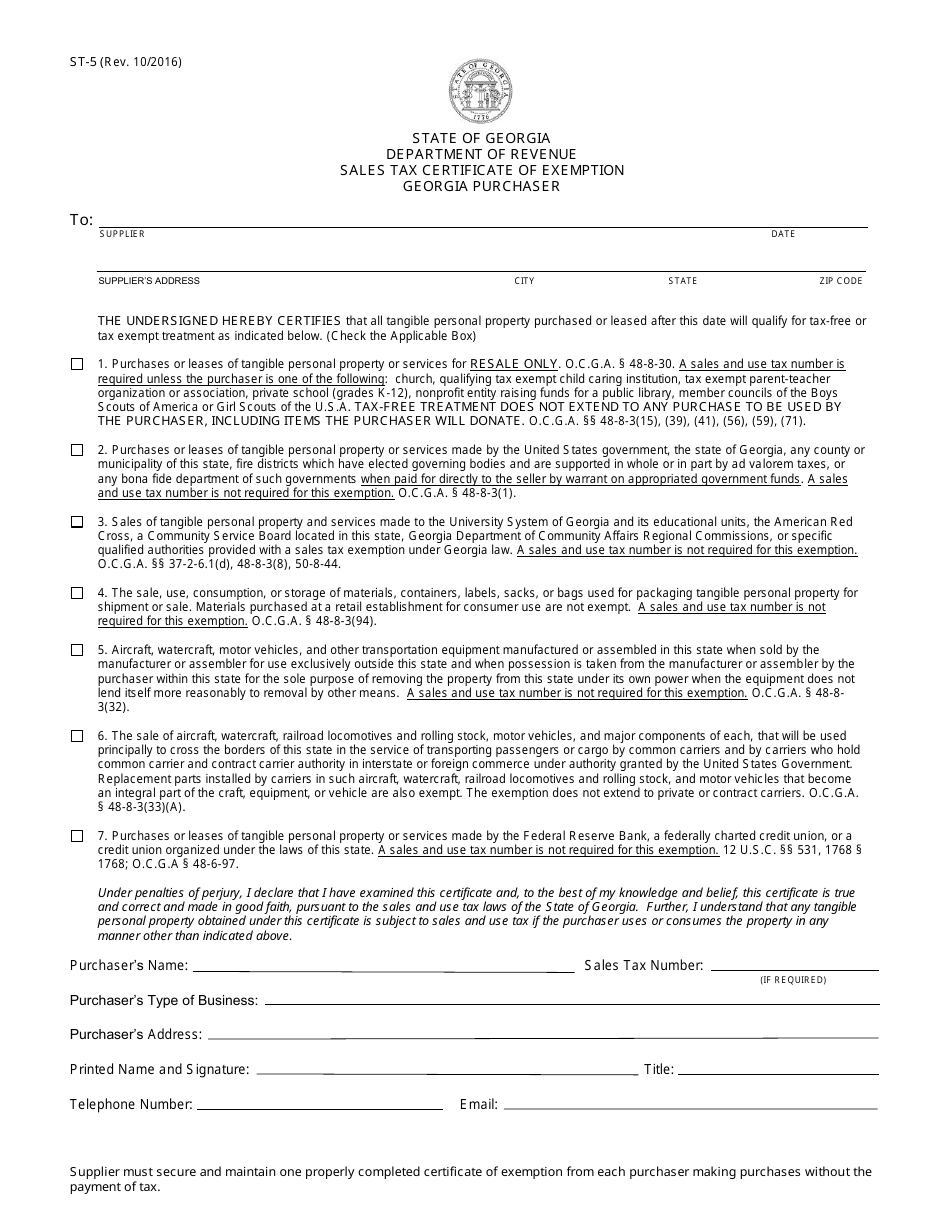

Form St 5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller

What Are Ad Valorem Taxes Henry County Tax Collector Ga

Georgia Used Car Sales Tax Fees

Property Tax Map Tax Foundation

How To Redeem A Tax Deed In Georgia Gomez Golomb Law Office Gomez Golomb Llc

Motor Vehicle Division Georgia Department Of Revenue

Frazer Software For The Used Car Dealer State Specific Information Georgia